Best Free AI Tools for Data Analysis in 2026: The “No-Cost” Power Stack From automated cleaning to predictive forecasting—master your data without the enterprise price

Category: Uncategorized

Is OPay Insured by NDIC? As Nigeria’s digital banking space grows, many users want to know if their money is safe. A common question is

How to Borrow Money on the Moniepoint App (2025 Guide) The knowledge that you can access quick, short-term funds through your smart device is a

Making a quite amount of money many times can require that you go extra length or take extra risks and these factors are likely to

As of February 17, 2025, the United Allied African Grant (UAAG) disbursement has not yet commenced. Beneficiaries are eagerly awaiting official confirmation regarding the disbursement

** PalmPay, through its loan service PalmCredit, allows users to borrow up to N100,000 instantly. The app is widely used and trusted by Nigerians for quick loans with flexible repayment terms. **How to Apply**: - Download the PalmPay app from the [Google Play Store](https://play.google.com/store/apps/details?id=com.palmpay.palmpay) or [Apple App Store](https://apps.apple.com/ng/app/palmpay/id1461188812). - Complete the registration process with your personal details and bank account information. - Apply for a loan by entering the amount (up to N100,000) and preferred repayment period. - Once approved, the loan is disbursed to your bank account almost instantly. **Requirements**: - You must be at least 18 years old. - A valid Nigerian bank account and phone number. - No collateral required. **Interest Rates**: Interest rates range between 10% and 15%, depending on the loan amount and repayment duration. **Pros**: - Instant loan disbursement. - Flexible repayment terms. - No collateral required. **Cons**: - Interest rates can be slightly higher than traditional bank loans. #### 2. **[Branch Loan](https://branch.co/)** Branch is one of the most popular loan apps in Nigeria, offering quick access to loans of up to N100,000. With its simple and efficient process, Branch is known for providing fast loans to Nigerians in need. **How to Apply**: - Download the Branch app from the [Google Play Store](https://play.google.com/store/apps/details?id=com.branch.bank) or [Apple App Store](https://apps.apple.com/ng/app/branch/id1026012271). - Sign up by providing your personal information and bank account details. - Request a loan by selecting the amount and repayment period. - The loan is disbursed to your bank account immediately after approval. **Requirements**: - You must be 18 years or older. - A valid Nigerian phone number and bank account. - Your credit history will influence loan approval. **Interest Rates**: Branch offers interest rates starting from 15% per annum, which may vary depending on your creditworthiness. **Pros**: - Fast and easy loan approval. - No collateral required. - Competitive interest rates. **Cons**: - Credit score and loan history impact loan approval. #### 3. **[FairMoney Loan](https://fairmoney.io/)** FairMoney is another top choice for Nigerians looking for quick access to loans. It offers loans up to N100,000 and is known for its simple loan application process and quick disbursement. **How to Apply**: - Download the FairMoney app from the [Google Play Store](https://play.google.com/store/apps/details?id=com.fairmoney) or [Apple App Store](https://apps.apple.com/ng/app/fairmoney/id1234611256). - Register by entering your personal information and bank account details. - Select the loan amount (up to N100,000) and the preferred repayment period. - Your loan is usually disbursed to your bank account almost instantly after approval. **Requirements**: - You need to be a Nigerian citizen or resident. - A valid phone number and Nigerian bank account are required. **Interest Rates**: FairMoney’s interest rates range from 20% per annum, depending on the loan amount and repayment terms. **Pros**: - No collateral or paperwork required. - Quick approval and loan disbursement. - Flexible repayment options. **Cons**: - Higher interest rates for larger loan amounts. #### 4. **[QuickCheck Loan](https://quickcheck.ng/)** QuickCheck is an easy-to-use loan app that offers loans up to N100,000. It is designed to provide quick loans without the need for collateral or paperwork, making it a popular choice for many Nigerians. **How to Apply**: - Download the QuickCheck app from the [Google Play Store](https://play.google.com/store/apps/details?id=com.quickcheck) or [Apple App Store](https://apps.apple.com/ng/app/quickcheck-loans/id1456863244). - Sign up by providing your details and linking your bank account. - Apply for a loan by selecting the amount and repayment period. - Once your loan is approved, the funds are disbursed to your account almost instantly. **Requirements**: - A valid Nigerian bank account. - A registered phone number with your bank. **Interest Rates**: QuickCheck offers interest rates between 10% and 20%, based on your credit score and the loan amount. **Pros**: - Fast approval and loan disbursement. - No collateral required. - Simple application process. **Cons**: - Interest rates can vary based on creditworthiness. #### 5. **[Migo Loan](https://www.migo.com/)** Migo is a trusted loan app that offers N100,000 loans instantly. Known for its easy access to funds, Migo provides a straightforward loan application process and fast disbursement. **How to Apply**: - Download the Migo app or sign up via the [Migo website](https://www.migo.com/). - Register with your phone number and provide your bank account details. - Apply for a loan by entering the amount and repayment duration. - After approval, the loan is credited to your account in minutes. **Requirements**: - A valid Nigerian phone number and bank account are required. - No collateral is needed, but your credit score will be considered. **Interest Rates**: Interest rates range from 5% to 15% based on your credit history. **Pros**: - Instant loan disbursement. - No paperwork or collateral needed. - Competitive interest rates. **Cons**: - Loan eligibility depends on your credit score. ### How to Choose the Right Loan App for N100,000 Loans When selecting a loan app for N100,000 loans, consider the following: 1. **Loan Amount and Eligibility**: Ensure the app offers loans of up to N100,000 and meets your specific financial needs. 2. **Interest Rates**: Look for apps with reasonable interest rates that won’t burden you with high repayment costs. 3. **Repayment Terms**: Choose a loan app with flexible repayment options that suit your budget and schedule. 4. **Loan Approval Time**: If you need the money urgently, opt for apps that provide instant loan disbursements after approval. 5. **User Experience**: Choose a loan app with a simple, intuitive interface and positive customer reviews. 6. **Credit History**: Some apps may require a credit check, so make sure your credit score is up to standard. ### Conclusion Loan apps in Nigeria have simplified the process of getting quick loans, especially for amounts like N100,000. Apps such as PalmPay, Branch, FairMoney, QuickCheck, and Migo offer fast and convenient loans with minimal documentation. When choosing a loan app, consider factors such as interest rates, repayment terms, and approval speed to ensure the app meets your financial needs. By doing your research and understanding the terms of each loan app, you can confidently choose the one that suits your requirements and helps you manage your financial emergencies efficiently.](https://innatemarketer.com/wp-content/uploads/2025/02/Which-loan-app-gives-100k-instantly.png)

In Nigeria, many people often face financial emergencies that require quick access to funds. Whether it’s for medical bills, business needs, or personal expenses, loan

Starting a t-shirt business can be an exciting venture, especially for those with a creative streak. The t-shirt industry is massive, with endless opportunities for

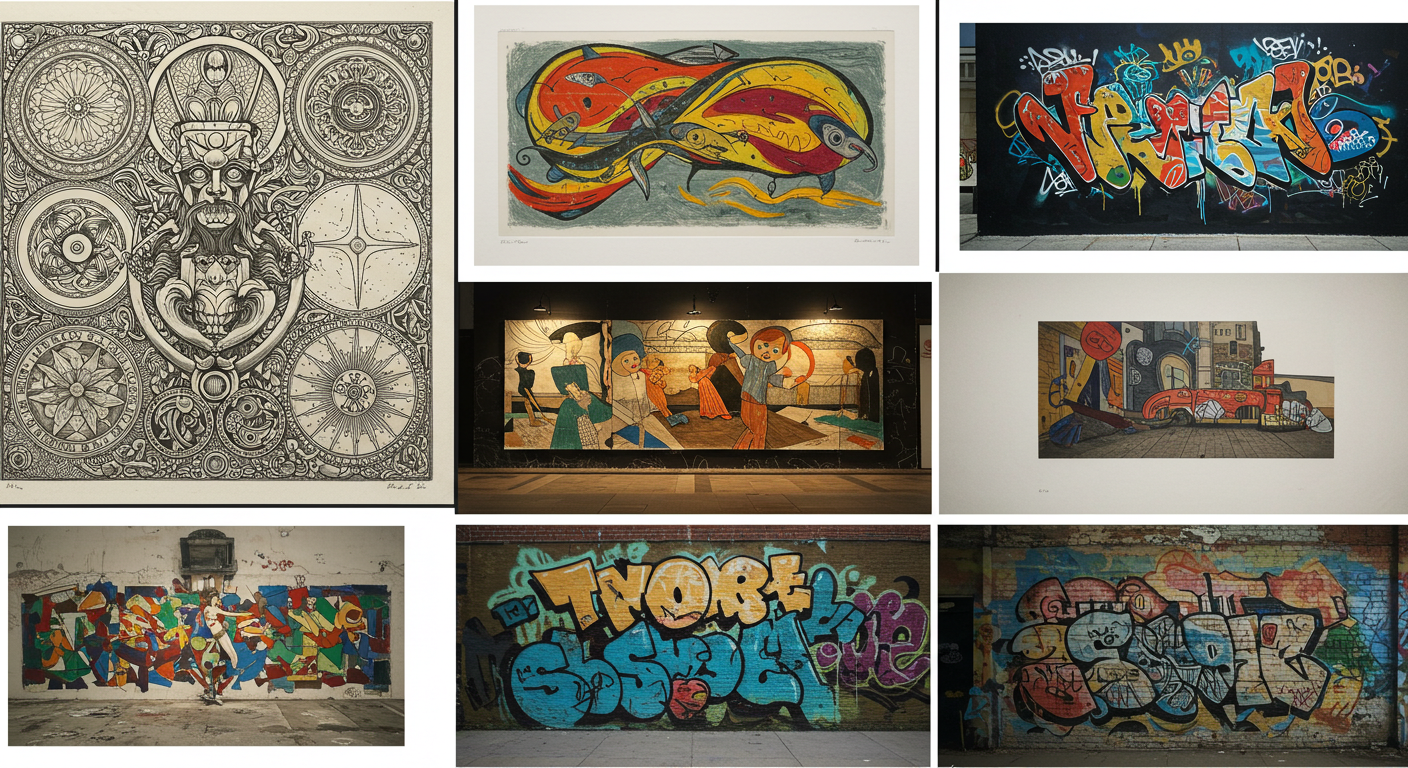

In today’s digital age, selling art online has become a lucrative opportunity for artists to make money and gain exposure. Whether you’re a seasoned artist

Are you a female professional looking to make a meaningful impact while advancing your career in Abuja’s dynamic NGO sector? Abuja is not only the

Nigeria’s banking sector is one of the most developed in Africa, with a wide variety of services tailored to meet the needs of both individuals